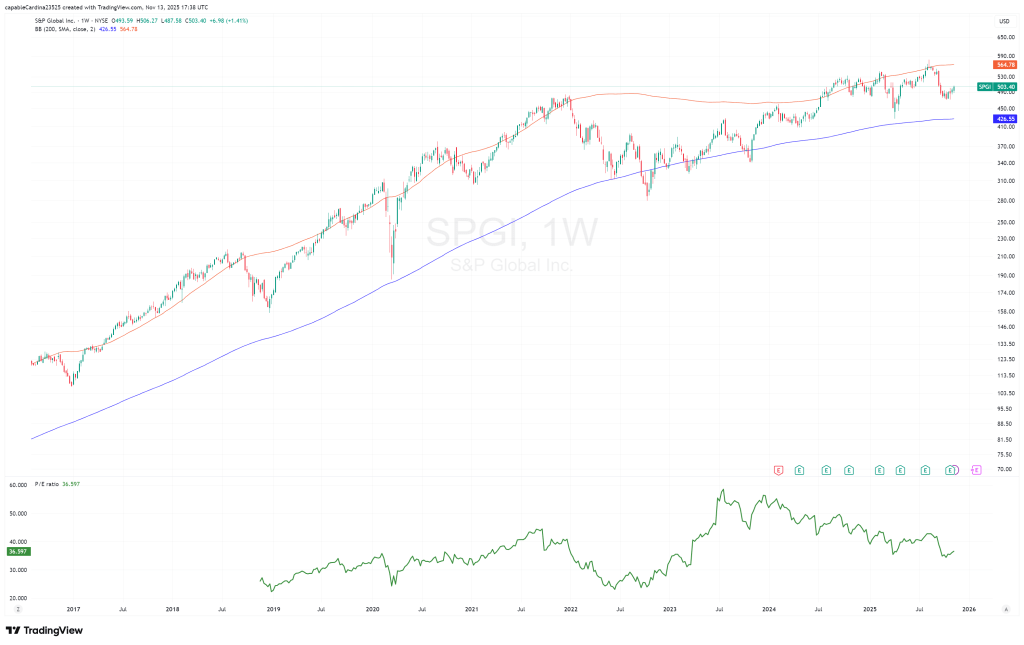

S&P Global stands out as a premier infrastructure provider in global finance, delivering essential credit ratings, market data, and benchmarks that are deeply embedded in the operations of banks, asset managers, and corporations worldwide. The company’s business model is built on highly recurring revenues from ratings, data subscriptions, and index licensing, supported by strong pricing power and high customer retention. Its entrenched position is protected by regulatory requirements, a trusted brand, and massive switching costs, creating a durable competitive moat. Financially, S&P Global boasts industry-leading operating margins (around 40%), robust free cash flow, and consistent double-digit EPS growth. With the stock currently trading below its historical valuation averages, S&P Global offers investors a rare combination of stability, profitability, and long-term compounding potential—making it an attractive buy for those seeking exposure to the backbone of modern financial markets.

(more…)